-

A Dimensional study shows that there are potential hidden costs associated with rigidly following an index.

-

The stocks that make up index funds can see increased trading volume and price pressure when indices are reconstituted.

-

A systematic daily investment process can help investors avoid the costs associated with index investing while still providing many of the benefits.

Imagine ringing in the new year in New York City’s Times Square with a million of your closest friends. Shortly after the ball drops, everyone is ready to leave—at the same time. Demand for a ride in that area soars, and so does the price for the suddenly coveted service. This dynamic surge is a lot like the index reconstitution effect, an important yet less-visible source of costs associated with index investing.

Index funds seek to mirror the performance of an index. To do that, they need to mirror the changes in the index’s holdings at the time of its reconstitution, when stocks are added to or dropped from the index. This lack of flexibility can lead to increased trading volume and price pressure around that reconstitution, the so-called index reconstitution effect.

Two of the most widely tracked indices in the US are the S&P 500 Index and the Russell 2000 Index. At the end of 2020, nearly $5.4 trillion in assets tracked the S&P 500. This means for every $1 invested in S&P 500 companies, 17 cents were indexed.1 An additional $191 billion in assets tracked the Russell 2000 as of 2019, meaning about 10 cents indexed for every $1 invested in Russell 2000 companies.2 With all of these assets tracking the indices, collective movements to mimic index changes may materially impact a security’s trading volume and price.

To examine the impact of index reconstitution on traded volumes and prices, we identify stocks that were added to or deleted from these two indices at an index reconstitution event over the past 10 years, from 2012 through 2021.3 Our sample includes 2,998 additions and deletions in total, with 50 additions and deletions coming from the S&P 500.

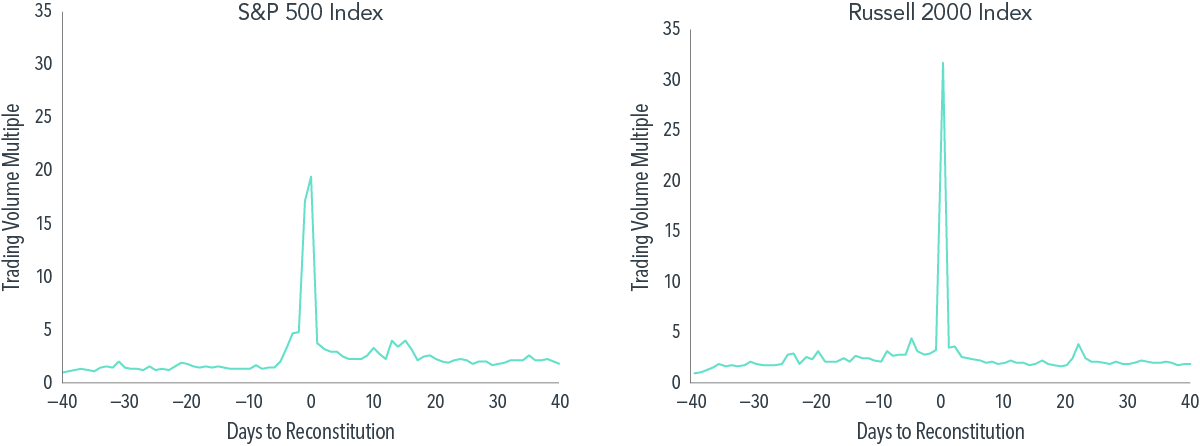

Exhibit 1 presents the value-weighted average trading volume for rebalanced stocks as a multiple of the stocks’ volume 40 trading days prior to reconstitution. For both the S&P 500 and Russell 2000, additions and deletions experience a large increase in trading volume around reconstitution, as much as 20 times higher for the S&P 500 and over 30 times higher for the Russell 2000, relative to volume before the reconstitution period.

Pump Up the Volume

Value-weighted average daily trading volume multiples for index additions and deletions, 2012–2021

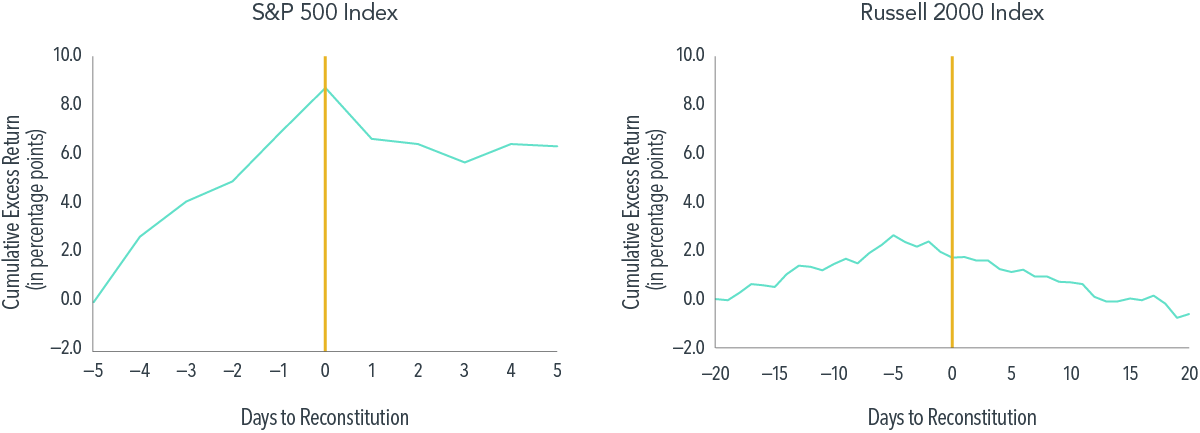

Exhibit 2 presents the value-weighted average cumulative excess return to added or deleted stocks relative to the index. For both indices, we observe an increase in cumulative excess returns from the announcement date to the reconstitution date, followed by a reversal in excess return in the days following, on average. For example, for S&P 500 additions and deletions, the average cumulative excess return climbed to almost nine percentage points over the five days prior to reconstitution and dropped by more than two percentage points the following day.

Get a Move On

Value-weighted average cumulative excess return of index additions and deletions since announcement dates, 2012-2021

Index investing has grown considerably in recent decades, with US equity index funds representing 52% of the US equity fund market at the end of 2021.4 While index funds typically offer lower expense ratios than actively managed funds, our study shows that there are potential hidden costs associated with rigidly following an index. Specifically, index fund investors end up buying index additions at high prices and selling index deletions at low prices. These results highlight the importance of flexibility and efficiency in portfolio design, portfolio management, and trading. A systematic daily investment process that rebalances thoughtfully and flexibly can help investors avoid the costs associated with demanding immediacy, while still providing many of the benefits of index investing.

Written by: Kaitlin Simpson Hendrix Senior Researcher and Vice President | Trey Roberts Associate, Research

Christine joined the NAM team in 2020, along with her six-plus years of Administrative and Executive Assistant experience. She was born and raised in Wisconsin. She has a love for film, comedy writing, and music, particularly between the 50’s and 80’s.

Christine joined the NAM team in 2020, along with her six-plus years of Administrative and Executive Assistant experience. She was born and raised in Wisconsin. She has a love for film, comedy writing, and music, particularly between the 50’s and 80’s. During my salad days, I studied business at the University of Minnesota and the Carlson School of Management. Taking this route seemed to make sense when I graduated high school, as it offered the opportunity to pursue a career in business. However, the experience didn’t go as planned. I found myself disillusioned by the focus and teachings of business school, with many of the lessons revolving around detached relationships focused solely on profit. I eventually concluded that this was not my personal path. I chose instead to purse a passion – writing – and veered off into journalism for the next six years of my life.

During my salad days, I studied business at the University of Minnesota and the Carlson School of Management. Taking this route seemed to make sense when I graduated high school, as it offered the opportunity to pursue a career in business. However, the experience didn’t go as planned. I found myself disillusioned by the focus and teachings of business school, with many of the lessons revolving around detached relationships focused solely on profit. I eventually concluded that this was not my personal path. I chose instead to purse a passion – writing – and veered off into journalism for the next six years of my life.